WHAT MILITARY FAMILIES NEED TO KNOW BEFORE THE TRICARE 2026 PRICE HIKE HITS

COMMENT

SHARE

ADVERTISEMENT

Military families depend on TRICARE as much as they depend on paychecks, commissary visits, and community support. Cost increases in 2026 directly impact your budget, pharmacy routine, and peace of mind.

TRICARE plans will cost more on January 1, 2026. Some changes are minor; others are bigger. With the right information, you can handle them with ease.

This toolkit has everything you need to adapt to these changes with confidence. Let’s break down what’s changing, who is affected, and the next steps to take.

What’s Changing in 2026

The Defense Health Agency has published the official 2026 cost tables. The biggest changes are for premium-based plans that you pay for each month.

- TRICARE Reserve Select (TRS): Member-only premium is $57.88 per month. Member-and-family premium is $286.66 per month.

- TRICARE Young Adult (TYA) Prime: Monthly premium is $794. TYA Select: Monthly premium is $363.

- TRICARE Retired Reserve (TRR): Member-only premium is $645.90. Member-and-family premium is $1,548.30.

Retiree and family plans, including Prime and Select, will also see some small updates.

- TRICARE Select Group A retirees: Annual enrollment fee is $186.96 for individuals and $375 for families.

- TRICARE Select Group A retirees: Annual catastrophic cap is $4,381.

Pharmacy copayments will also change.

- Home delivery (90-day supply): Generic copay is $14, brand-name copay is $44, and non-formulary copay is $85.

- Retail network copays adjust accordingly (30-day supply): Tier 1 generic is $16, Tier 2 brand-name is $48, and Tier 3 non-formulary is $85. Military pharmacies remain $0.

Families using brand-name or specialty medications should review these changes with their provider.

Nobody Prepared You for Military Life

But we can help. Join over 100k spouses already getting the advice, resources, and military tea they need to thrive.

What’s Staying Consistent

Covered services will still include preventive care, maternity care, mental health services, prescription drugs, and chronic condition management.

The 2026 changes are about premiums and cost-shares, not cutting covered benefits.

Your beneficiary group (A or B), sponsor status, and where you get care will still decide your costs and requirements.

Open Season and Timing

Open Season for 2025 is from November 10 to December 9. Any changes you make during this time will start on January 1, 2026.

This applies to TRICARE Prime and TRICARE Select enrollments and changes.

You can buy or change premium-based plans (TRS, TRR, TYA, Continued Health Care Benefit Program) at any time during the year.

Here’s What the TRICARE Changes Mean for Your Family

Enrollment fees, deductibles, catastrophic caps, and pharmacy copays rise for most TRICARE users in 2026.

- Active-duty families see small shifts.

- Retirees and premium-based plan users see larger ones.

- Pharmacy costs go up for almost everyone.

Knowing your plan, how you use care, and where to adjust helps you protect your budget and avoid surprises next year.

ADVERTISEMENT

Why TRICARE Costs Are Rising in 2026

Federal law changes TRICARE costs annually to keep pace with rising medical costs and inflation. In 2026, TRICARE Prime and Select will rise about 2–3 percent. Premium-based plans like Reserve Select and Young Adult will see larger increases due to higher use and costs.

Active-duty families still pay no TRICARE Prime enrollment fee. Families using Select, especially Group B, will see higher deductibles and catastrophic caps.

“Take the time now to review your 2026 TRICARE health plan costs. They will help you decide if you want to keep your family’s current coverage or change your enrollment during TRICARE Open Season.” — Debra Fisher, TRICARE Health Plan.

Prime vs. Select: Which Plan Fits Best in 2026?

With all the changes in mind, let’s compare how TRICARE Prime and TRICARE Select stack up for different needs.

TRICARE Prime

TRICARE Prime is typically best for families seeking predictable costs, frequent specialist use, and who are comfortable using referrals and a managed process for accessing care.

This plan works well for those who value cost certainty over provider flexibility.

If your family expects frequent healthcare visits or specialist appointments, Prime’s structured approach and lower copays will often save you money and reduce surprises.

ADVERTISEMENT

TRICARE Select

TRICARE Select is generally best for families who value flexibility in choosing healthcare providers, require easy access during PCS transitions, and expect to use fewer medical services annually.

This plan is ideal for those preferring provider choice over strict cost predictability.

If your family expects to use medical services only occasionally, Select can offer better value through its lower annual fees and flexible provider access.

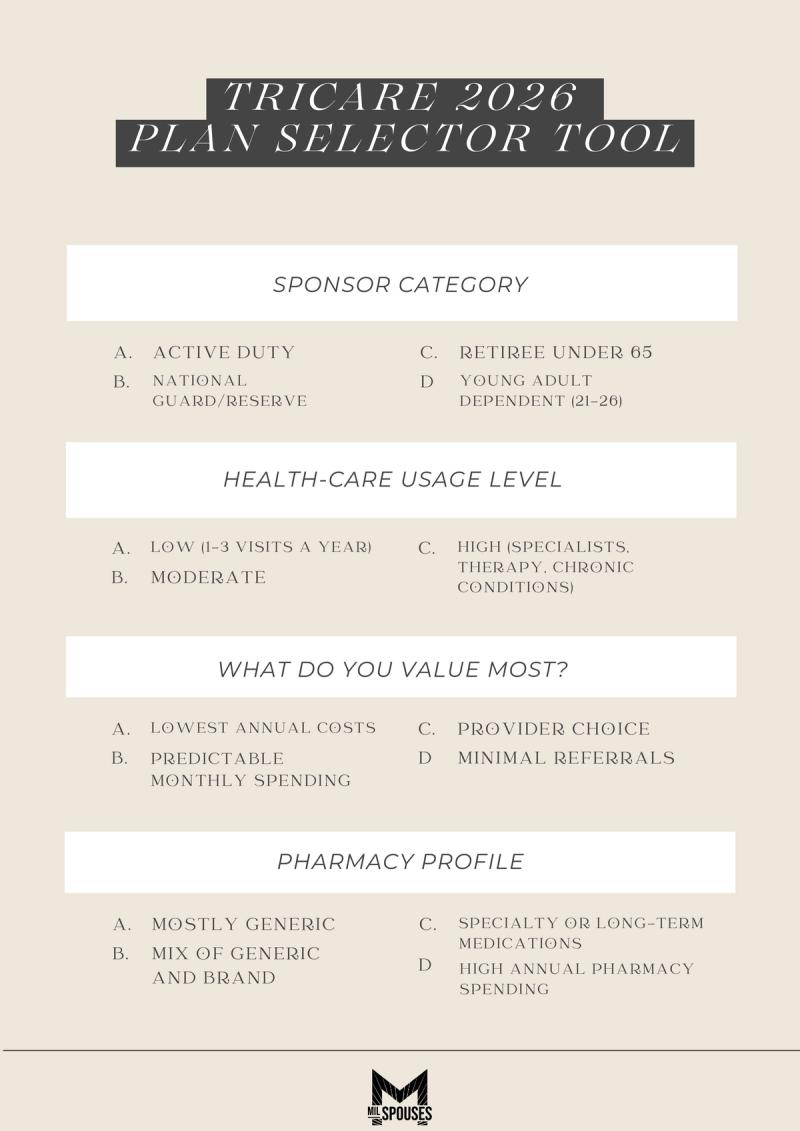

TRICARE 2026 Plan Selector Tool

Answer the questions below, then follow the matching recommendation in the chart.

A Practical Checklist to Prepare for 2026

- Review your current TRICARE plan. Confirm your 2025 selections and compare them with the new 2026 rates. For Prime or Select, check your beneficiary group and copays.

- Update DEERS and contact info. Check your eligibility, address, and dependent details. Correct information helps ensure accurate bills and notices.

- Outline the expected 2026 care. List routine visits, scheduled procedures, and specialist needs. Decide if Prime’s structure or Select’s flexibility fits better.

- Budget for premiums and meds. Add new premiums and copays to monthly expenses. For regular meds, compare home delivery with new copays to current costs.

- Review TYA options for dependents. If adult children are covered, compare TYA premiums to school or employer plans, considering total cost and expected care.

- Choose to keep or change coverage. If current coverage works, keep it. If not, make your changes during Open Season (for Prime/Select) or update premium-based plans as needed. Changes during Open Season begin on January 1, 2026.

ADVERTISEMENT

2026 Readiness Starts With Clarity

To maximize savings and ensure preparedness, military families should prioritize clarity and proactive planning. Start by reviewing the 2026 plan figures and coverage to make necessary updates before January 1st, avoiding surprises.

Implement smart strategies throughout the year by using in-network providers whenever possible, shifting long-term medications to cost-effective home delivery after confirming their formulary status and pricing, and scheduling non-urgent care with your budget in mind.

Finally, track your progress toward the catastrophic cap, save the new year's budget numbers for quick reference, and share a concise summary of plan details—including booking and after-hours support—with all covered family members, ensuring everyone is on the same page for optimal financial and health readiness.

Suggested reads:

Join the Conversation

BY NATALIE OLIVERIO

Veteran & Senior Contributor, Military News at MilSpouses

Natalie Oliverio is a Navy Veteran, journalist, and entrepreneur whose reporting brings clarity, compassion, and credibility to stories that matter most to military families. With more than 100 published articles, she has become a trusted v...

- Navy Veteran

- 100+ published articles

- Veterati Mentor

ADVERTISEMENT

ADVERTISEMENT